CCA Weekly Commentary: CCAs trade in the $38.80+ range with negligible WoW gains; trade activity notes an uptick as investors prepare for the holiday season

December 4, 2023 by Megha Jha

This Week’s Highlights

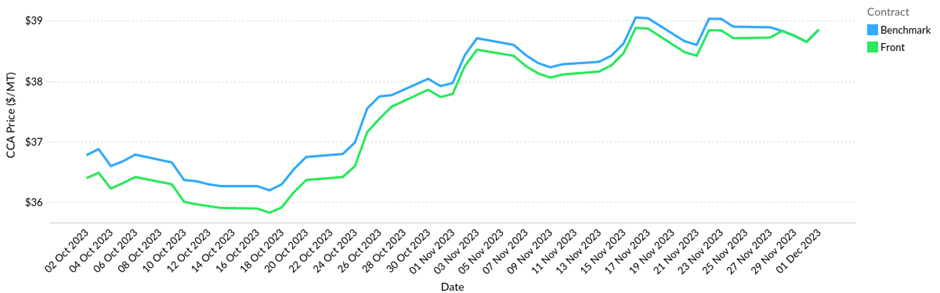

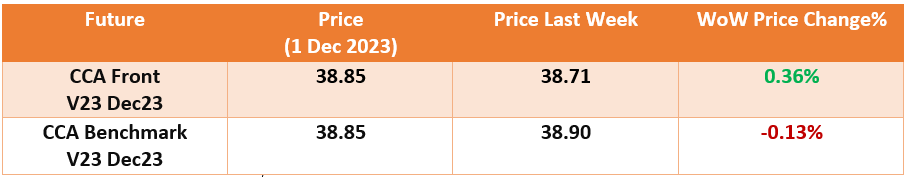

- Intercontinental Exchange (ICE) CCA V23 Front on Thursday closed at $38.85 gaining 0.36% over the week.

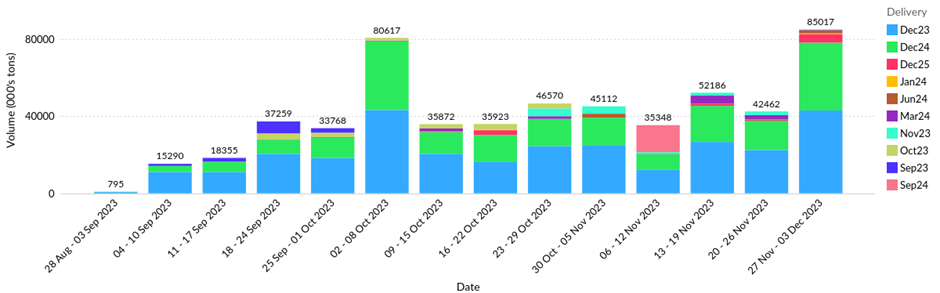

- ICE weekly volume was reported as 85.02 M (+21.97% WoW) and the 4-week moving average was reported as 53.75 M tons.

- CFTC: Open Interest down by 2.38 M tons; compliance entities increased long positions by 0.60 M tons, and managed money increased long positions by 1.38 M tons.

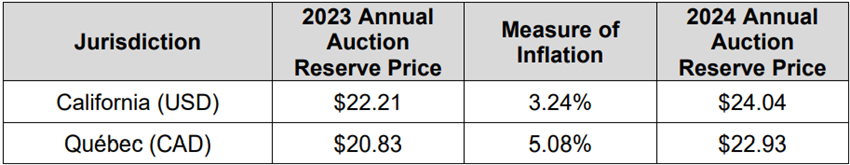

- CARB released the updated auction reserves for 2024.

- CARB’s cap-and-trade program amendments’ initial draft is expected in Q1 of 2024.

- DOE revealed massive lithium reserves in California’s Salton Sea, potentially revolutionizing EV battery production.

cCarbon’s Market View This Week

CCAs have exhibited a slowdown in the pace of their bullish uptrend, which has been evident since mid-October, with negligible gains over the previous week. Concurrently, trading activity has picked up as the year draws to a close, and investors prepare for the holiday season.

On December 1, CARB released the updated auction reserves for 2024 in their 2024 Annual Auction Reserve Price notice.

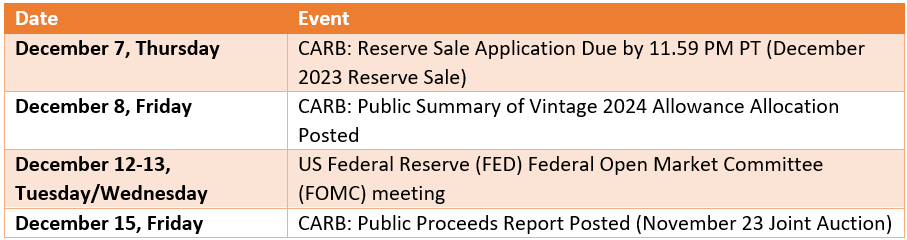

From a macroeconomic perspective, the market is anticipated to continue its current price trajectory into Q1 of 2024. The upcoming Federal Open Market Committee (FOMC) meeting scheduled for December 12-13 is expected to maintain interest rates in the 5.25-5.50% range. Federal Reserve Chairman Jerome Powell’s recent remarks have tempered market expectations for aggressive interest rate cuts.

As the market awaits the materialization of amendments to the cap-and-trade program by the California Air Resources Board (CARB), with the initial draft expected in Q1 of 2024, participants and investors anticipate a tighter market, with prices potentially breaching the $50 range during the same period.

Little to no significant market development is expected in the coming weeks as the market prepares for the upcoming holiday season and digests the regulatory updates received since June this year. This is particularly pertinent as the ongoing compliance period draws to a close at the end of December. Market participants will likely notice slower trade and developments in the final weeks of the year.

Price and Volume Trends

CCAs held their ground over the week, maintaining prices in the $38.80+ range throughout the week with marginal week-on-week gains. Both V23 front and benchmark allowance prices are consistently trading in the same price band, aligning with the initiation of trading for the Dec23 front contract last week. The week concluded with both V23 front and benchmark allowances closing at $38.85.

In contrast to the relatively stable price movements, volumes experienced a robust uptick in trading activity with volumes up by 21.97% week-on-week. This increased trade activity can be attributed to several factors: a surge in trading close to the year-end ahead of holidays, the aftermath of a record high auction settlement as traders anticipate higher allowance prices with increased market stringency starting Q1 of 2024, and the shifting of deliveries at year-end.

Trader Positions

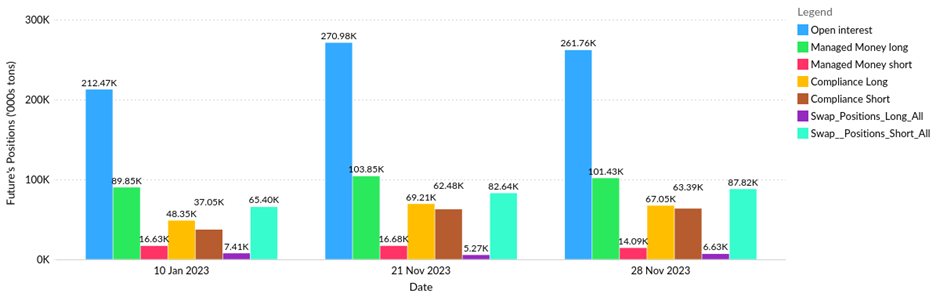

CFTC V23: Positions across all traders (28 Nov)

In the CFTC data last reported on Nov 28, 2023, the Open Interest (OI) declined by 9.22 M tons. The compliance entities increased short positions by 0.90 M tons, and managed money decreased short positions by 2.60 M tons.

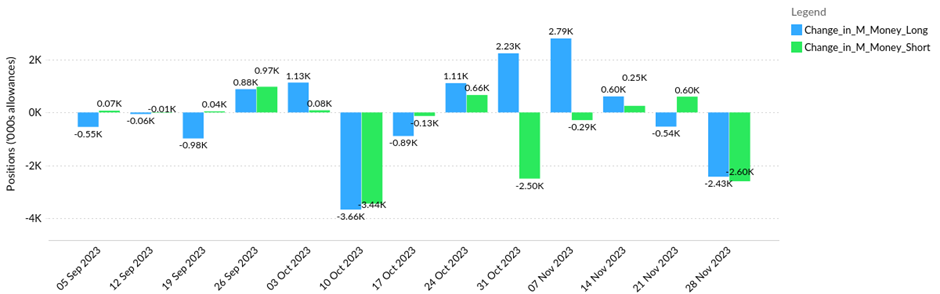

CFTC V23: Fund Manager change in positions (28 Nov)

Managed money decreased long and short positions by 2.43 M tons and 2.60 M tons respectively.

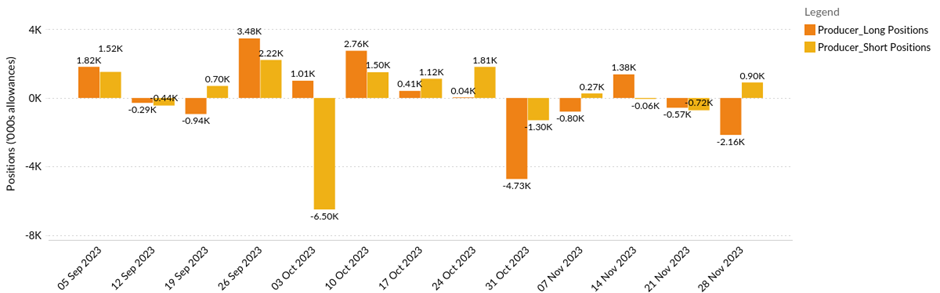

CFTC V23: Covered entity change in positions (28 Nov)

Compliance entities decreased long positions by 2.16 M tons and increased short positions by 0.90 M tons.

Upcoming Key Dates

California Market Drivers

DOE Revealed Massive Lithium Reserves in California’s Salton Sea, Potentially Revolutionizing EV Battery Production

The U.S. Department of Energy (DOE) disclosed groundbreaking findings on the domestic lithium resources in California’s Salton Sea region. According to the comprehensive analysis by DOE’s Lawrence Berkeley National Laboratory, the region has the potential to yield over 3,400 kilotons of lithium with anticipated technological advancements. This abundance could support more than 375 million electric vehicle (EV) batteries, surpassing the current number of vehicles on U.S. roads. The analysis affirms the Salton Sea’s crucial role as a significant domestic source of lithium, vital for both electric vehicle and stationary storage batteries, aligning with the Biden-Harris Administration’s ambition for a net-zero emissions economy by 2050.

Biden-Harris Administration Unveils Dynamic Framework for Accelerated Greenhouse Gas Monitoring

The Biden-Harris Administration has introduced a pioneering conceptual framework aimed at establishing a national system for the continuous measurement, monitoring, and dissemination of information crucial to reducing greenhouse gas (GHG) emissions, aligning with U.S. commitments under the 2015 Paris Agreement. Partnering with the National Oceanic and Atmospheric Administration (NOAA), renowned for its expertise in GHG measurements, the initiative involves more frequent updates, transitioning from annual to biannual or quarterly reporting. This innovative approach facilitates real-time data for regional and local planners, enabling enhanced monitoring and verification of GHG emissions mitigation plans. Valuable insights gained from the prototype will inform future endeavors to scale up the information system and refine GHG emissions modeling, particularly in urban areas.

Other Market Fundamentals

- The U.S. Bureau of Labor Statistics revealed that the Consumer Price Index for All Urban Consumers (CPI-U) remained stable in October, following a 0.4 percent rise in September. Despite a flat month, the consumer price index, measuring a diverse range of goods and services, displayed a 3.2% year-over-year increase, as reported by the Labor Department’s seasonally adjusted figures.

- OPEC+ producers agreed on Thursday to remove around 2.2 million barrels per day (bpd) of oil from the global market in the first quarter of next year, which included a rolling over of Saudi Arabia and Russia’s current 1.3 million bpd of voluntary cuts. Meanwhile, the U.S. oil rigs rose by 5 week-on-week but have declined by 122 to 505 total year over year, according to data released by Baker Hughes on Friday.

- Oil prices dropped 2% Friday, adding to losses from the day prior with the market skeptical of the latest round of production cuts by OPEC+ and as U.S. rigs rose week over week. Brent crude futures for February dropped $2.02 to $78.84 a barrel and U.S. West Texas Intermediate (WTI) crude futures fell $1.95 to $74.01 a barrel.

CC.info Readers Digest

- Navigating California’s Transportation Emissions: 2022 Marks a Pivotal Reduction, Thanks to the Impact of Renewable Diesel

- California-Quebec Cap-and-Trade Emission and Pricing Outlook

- 2030 WCI (Western Climate Initiative) Emissions and Price Forecast | Analyst Note

Analyst Contact

- Megha Jha (mjha@ckinetics.com)

- Craig Rocha (cmrocha@ckinetics.com)