RGGI Weekly Commentary: RGA allowances continue to trade above the CCR trigger price of $14.90 – cCarbon expects additional CCR allowances to enter the market in the upcoming auction

November 24, 2023 by Megha Jha

This Week’s Highlights

- ICE RGGI V23 Front on Thursday: $14.90 (0% WoW).

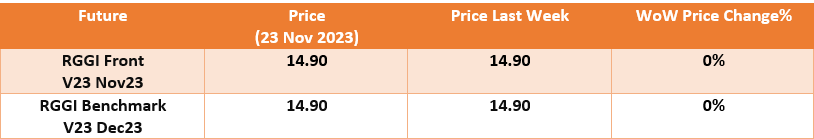

- ICE weekly volume was reported as 7.44 M tons (+76.23% WoW).

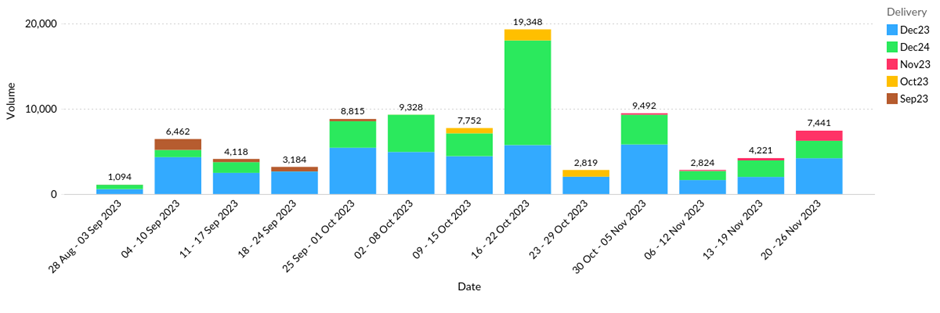

- CFTC: Open Interest up by 0.58 M tons; compliance entities increased short positions by 0.60 M tons, and managed money increased short positions by 0.02 M tons.

- Governor Josh Shapiro’s administration announced its decision to appeal the Commonwealth Court’s ruling that initially prevented Pennsylvania from joining the RGGI program.

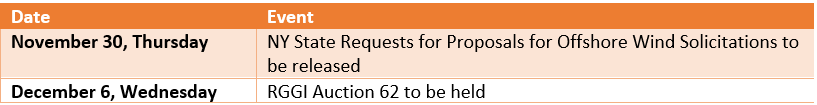

- Auction 62 to be held on December 6, is expected to offer 22 million allowances and an additional 11.25 million allowances available if the CCR trigger price is breached, which has a high probability according to cCarbon analysts.

- Governor Kathy Hochul announced the successful installation of the inaugural offshore wind turbine for South Fork Wind, marking a historic achievement in New York’s offshore wind development.

cCarbon’s Market View This Week

RGAs have exhibited a relatively bullish trajectory since the commencement of Q3, marking a gradual 12.88% increase in prices between the beginning of July and November 23. This week, the Governor’s administration announced its decision to appeal the Commonwealth Court’s ruling that initially prevented Pennsylvania from joining the RGGI program. The attempt is a last-ditch effort and unlikely to change the court’s decision.

The reasons for the all-time high price above the Cost Containment Reserve (CCR) trigger price are:

- The elimination of low-cost abatement opportunities due to the program exit of Virginia and Pennsylvania will significantly elevate the intrinsic value of RGAs.

- The program review draft, expected early next year, is anticipated to reduce the CAP to either a net-zero CAP by 2035 or 2040. This comes along with the possibility of other stringency mechanisms and an upliftment of the CCR price.

- The absence of Virginia and Pennsylvania in the program review means that RGGI would have more support in pushing through a more ambitious and stringent program post-2024.

- The CCR trigger price for 2024 is $15.92, hence the market sees value even at current high prices.

Looking ahead to the upcoming fourth quarter, the RGGI auction on December 6 will offer 22 million allowances along with up to 11.25 million additional allowances if the CCR trigger price is breached. There is a sense that this auction may be the last chance to acquire allowances at current prices. This prospect could motivate compliance entities and investors to either hedge risks or engage in opportunistic buying. Notably, since November 17, allowance prices have consistently traded above the CCR, which increases by 7% annually and is set to reach $15.92 in 2024. The release of cost-containment reserve allowances to the market in the upcoming auction is seen as highly likely.

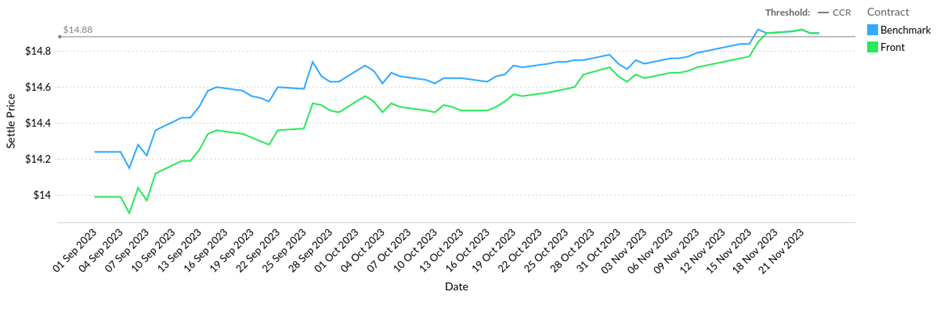

Price and Volume Trends

Throughout the week, RGAs V23 front and benchmark prices followed a consistent trajectory, remaining above the CCR of $14.88. Despite a slight increase in prices between November 17 and November 23, allowance prices recorded no week-on-week change, holding steady at $14.90 on both dates. Simultaneously, RGAs experienced an increase in trading volumes over the week. However, on Thursday, volumes were up by 76.23% on a week-on-week basis, reaching 7.44 million tons.

Trader Positions

*Note: Due to an early publication of the commentary this week, the CFTC data is not yet updated for this week and the numbers included below are the latest available till November 24, Friday.

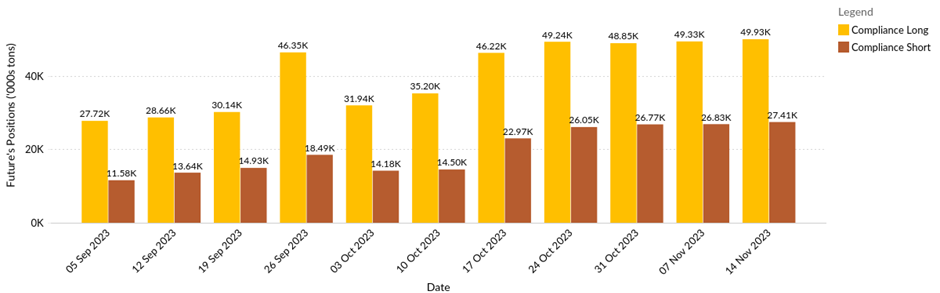

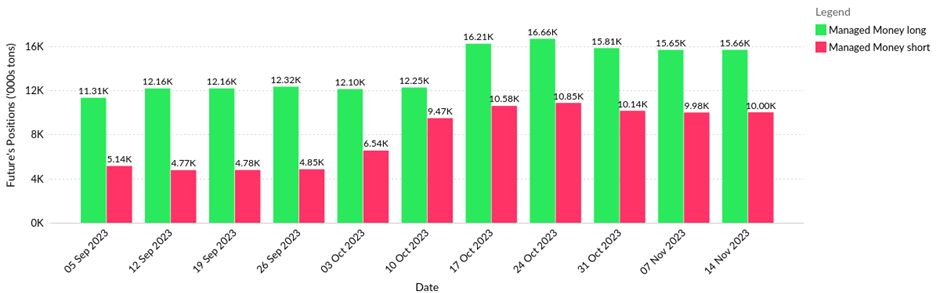

An analysis of traders’ positions from CFTC data gives us an indication of market sentiments. The OI observed an increase by 0.58 M tons over the previous week. Compliance entities increased short positions by 0.60 M tons, and managed money increased short positions by 0.02 M tons.

Total Positions (Positions on November 14, 2023)

Compliance Entities (Net Increase: 0.02 M tons):

- Long positions increased by 0.60 M tons

- Short positions increased by 0.58 M tons

Managed Money (Net Increase: 0.01 M tons):

- Long positions increased by 0.01 M tons

- Short positions increased by 0.02 M tons

Upcoming Key Dates

RGGI Market Drivers

Pennsylvania Governor Appeals Block on Regional Greenhouse Gas Initiative Entry

Governor Josh Shapiro’s administration revealed on Tuesday its decision to appeal the Commonwealth Court’s ruling preventing Pennsylvania from joining the RGGI program. The Nov. 1 decision, which addressed questions of executive authority, was contested by Shapiro, who emphasized the need to safeguard this authority. A spokesperson stated that the Governor is prepared to implement recommendations from the RGGI Working Group. Additionally, Shapiro is open to endorsing legislation that replaces RGGI with a Pennsylvania-based or PJM-wide cap-and-invest program, aligning with proposals from the working group.

Governor Hochul Celebrates Milestone as First Offshore Wind Turbine Powers Up

Governor Kathy Hochul announced the successful installation of the inaugural offshore wind turbine for South Fork Wind, marking a historic achievement in New York’s offshore wind development. The 130-megawatt wind farm, the first of its kind in federal waters, addresses Long Island’s grid reliability challenges, generating renewable energy for approximately 70,000 homes and reducing up to six million tons of carbon emissions—equivalent to removing 60,000 cars annually for 25 years. This step aligns with the State’s Climate Leadership and Community Protection Act goal, targeting nine gigawatts of offshore wind by 2035. South Fork Wind aims to complete all 12 Siemens Gamesa turbines by late 2023 or early 2024, fostering a local union job-focused domestic supply chain.

Other Market Fundamentals

- On November 1, 2023, the Commonwealth Court of Pennsylvania, in a five-judge panel decision, issued a long-awaited ruling denying the authority of the executive branch, through the Pennsylvania Department of Environmental Protection (DEP), to bind Pennsylvania as a member of the RGGI. On November 21, 2023, Gov. Josh Shapiro announced his intention to appeal the court decision.

- Judge Michael Wojcik, in two Commonwealth Court rulings, declared the Pennsylvania Department of Environmental Protection and Environmental Quality Board’s carbon emissions plan a constitutional violation, asserting that participation in RGGI requires legislative enactment, not just agency rulemaking. The court voided the regulation and enjoined enforcement.

- The U.S. Bureau of Labor Statistics revealed that the Consumer Price Index for All Urban Consumers (CPI-U) remained stable in October, following a 0.4 percent rise in September. Despite a flat month, the consumer price index, measuring a diverse range of goods and services, displayed a 3.2% year-over-year increase, as reported by the Labor Department’s seasonally adjusted figures.

- Natural gas futures declined by 5.23% to $2.90 week-on-week on November 22, Thursday.

- Nasdaq Composite Index rose by 0.99% WoW to 14,265 on November 22, Thursday.

CC.Info Readers Digest

- RGGI Public Meeting Update: Is RGGI required anymore? Federal Incentives to drive decarbonization

- RGGI Market Forecast: A stranded assets outlook

Analyst Contact:

- Megha Jha (mjha@ckinetics.com)

- Craig Rocha (cmrocha@ckinetics.com)