RGGI Weekly Commentary: RGAs sustain bullish, settling at $14.88 (CCR) on high trade volumes; Four prominent environmental groups in Pennsylvania challenge the court’s ruling blocking RGGI

December 4, 2023 by Megha Jha

This Week’s Highlights

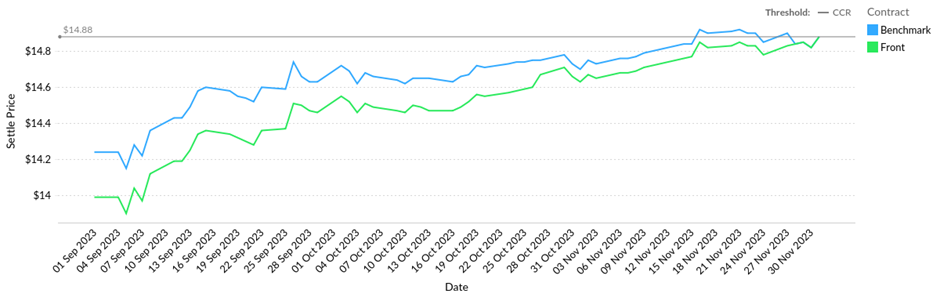

- ICE RGGI V23 Front on Friday: $14.88 (+0.68% WoW).

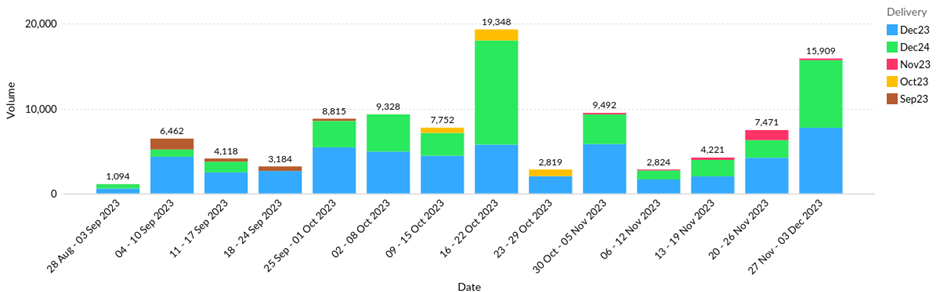

- The ICE weekly volume was 15.91 M tons (+112.7% WoW).

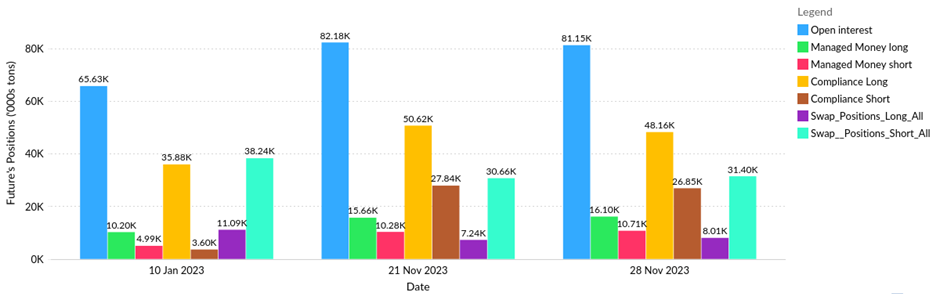

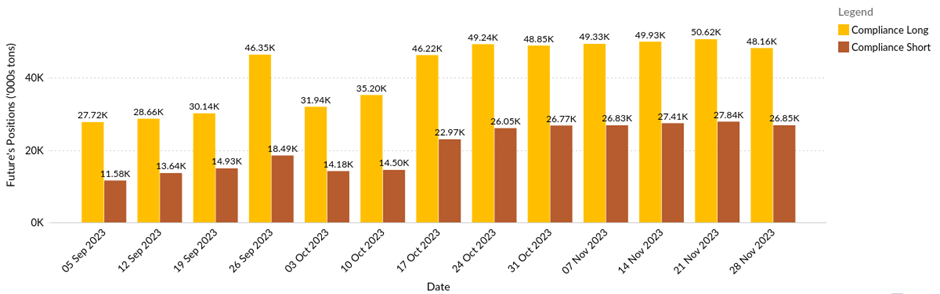

- CFTC: Open Interest down by 1.03 M tons; compliance entities decreased long positions by 2.46 M tons, and managed money increased long positions by 0.44 M tons.

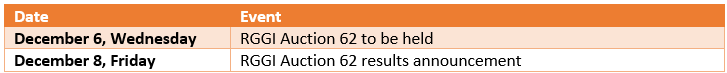

- Auction 62 is to be held on December 6, Wednesday and results will be announced on December 8, Friday.

- Four prominent environmental groups in Pennsylvania challenge the Court’s ruling and advocate for the state’s participation in the RGGI.

cCarbon’s Market View This Week

RGAs maintained their bullish trajectory, closing at the Cost Containment Reserve (CCR) on Friday. As the current three-year control period is set to conclude by the end of the year, the CCR trigger price is expected to increase by 7% annually, reaching $15.92 in 2024.

In line with the price trend noted over the week, volumes traded in the market also saw a significant uptick, increasing by 112.7% and reaching 15.91 M tons by Friday. This surge in trading activity aligns with heightened market sentiments ahead of the upcoming Auction 62 scheduled for December 6, Wednesday. Investors are actively engaging in trade activities and purchasing more allowances in anticipation of the auction. cCarbon anticipates the auction to clear at the CCR, with the settlement price expected to be $14.88.

Following Governor Shapiro’s appeal filed the previous week, objecting to the Commonwealth Court’s ruling preventing the state from participating in the Regional Greenhouse Gas Initiative (RGGI), four prominent environmental groups in Pennsylvania—PennFuture, Clean Air Council, Sierra Club, and Environmental Defense Fund (EDF)—have jointly appealed the decision. Although we anticipate the likelihood of the decision being overruled or revoked by the courts to be relatively low, the state continues its efforts to remain in the RGGI.

Price and Volume Trends RGAs sustained a relatively bullish uptrend throughout the week, closing at the CCR of $14.88 on Friday. Volumes traded in the market experienced a significant uptick, registering gains of 112.7% at 15.91 M tons over the week. This surge in trading activity is attributed to investors purchasing allowances in anticipation of Auction 62 scheduled for December 6. Market participants exhibit continued confidence in RGAs, with investors actively positioning themselves ahead of the upcoming auction.

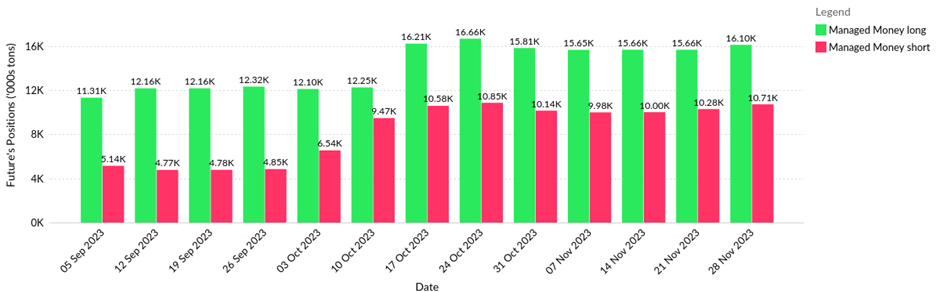

Trader Positions

An analysis of traders’ positions from CFTC data gives us an indication of market sentiments. The OI observed a decline of 1.03 M tons over the previous week. Compliance entities decreased long positions by 2.46 M tons, and managed money increased long positions by 0.44 M tons.

Total Positions (Positions on November 28, 2023)

Compliance Entities (Net Increase: 3.45 M tons):

- Long positions decreased by 2.46 M tons

- Short positions decreased by 0.99 M tons

Managed Money (Net Increase: 0.01 M tons):

- Long positions increased by 0.44 M tons

- Short positions increased by 0.43 M tons

Upcoming Key Dates

RGGI Market Drivers

Environmental Groups Challenge Pennsylvania Court’s Ruling, Advocate for State Participation in Regional Greenhouse Gas Initiative

Four prominent environmental organizations in Pennsylvania—PennFuture, Clean Air Council, Sierra Club, and Environmental Defense Fund (EDF) —have jointly appealed the Commonwealth Court’s November 1 decision preventing the state’s entry into the Regional Greenhouse Gas Initiative (RGGI). This legal action aligns with Governor Josh Shapiro’s recent appeal, filed just before the 30-day deadline, expressing concerns over the potential impact on the authority of future governors. The environmental groups issued a collective statement urging the Pennsylvania Supreme Court to overturn the previous Commonwealth Court rulings, emphasizing the importance of the state’s participation in RGGI for advancing environmental goals and combating climate change.

New York Surges Ahead with Over Two Gigawatts of Community Solar, Paving the Way to Clean Energy Accessibility

Governor Kathy Hochul has declared a significant milestone in New York, with the installation of over two gigawatts of community solar, sufficient to power 393,000 homes. This achievement solidifies the state’s leading position as the foremost community solar market in the United States. The announcement contributes to the broader landscape of five gigawatts of distributed solar currently operational in the state, accompanied by an additional 3.3 gigawatts in development. New York’s commitment to its Climate Leadership and Community Protection Act is evident in this progress, targeting six gigawatts of distributed solar by 2025, en route to an ambitious 10 gigawatts by 2030. Community solar facilitates solar access for homeowners, renters, and businesses lacking ideal on-site conditions for solar panel installation. Under this model, clean energy is seamlessly integrated into the electric grid, offering subscribers credits on their electric bills for their share of the solar system’s output.

Other Market Fundamentals

- Four prominent environmental organizations in Pennsylvania—PennFuture, Clean Air Council, Sierra Club, and Environmental Defense Fund (EDF) —have jointly appealed the Commonwealth Court’s November 1 decision to block the state’s participation in RGGI.

- The U.S. Bureau of Labor Statistics revealed that the Consumer Price Index for All Urban Consumers (CPI-U) remained stable in October, following a 0.4 percent rise in September. Despite a flat month, the consumer price index, measuring a diverse range of goods and services, displayed a 3.2% year-over-year increase, as reported by the Labor Department’s seasonally adjusted figures.

- Natural gas futures declined by 3.10% to $2.81 week-on-week on December 1, Friday.

- Nasdaq Composite Index rose by 2.81% WoW to 14,305 on December 1, Friday.

CC.Info Readers Digest

- RGGI Public Meeting Update: Is RGGI required anymore? Federal Incentives to drive decarbonization

- RGGI Market Forecast: A stranded assets outlook

Analyst Contact:

- Megha Jha (mjha@ckinetics.com)

- Craig Rocha (cmrocha@ckinetics.com)